Maximum Benefits for a Major Medical Plan Are Usually Lifetime

EHealths plan finder tool lets you look up and compare costs like premiums deductibles copayments and more for a wide selection of individual and family plans. What policy feature in major medical policies allows the maximum lifetime benefit to be restored to its original amount after a large portion of the benefits have been used.

Qualified Health Plan Definitions Under Obamacare

And just as the maximum benefit amount can vary considerably so can the stop-loss limit depending upon the individual policy and insurer.

. In contrast to basic medical expense insurance major medical policies provide total maximum lifetime benefits to individual insureds from about 250000 to 1000000 or more. Lifetime reserve days can be used in one hospital stay or across multiple stays. That coverage rises to 145 million after Sept.

Lifetime maximum benefit limits on current health care policies may range from 100000 to 2 million with some policies even having unlimited benefits. The law phases out these annual limits over a period of three years. Therefore the maximum does not apply to.

It covers a large amount of possible financial expenses including hospital room and board hospital extras nursing services in-hospital or at home blood oxygen prosthetic devices surgery physicians. Lifetime maximum benefit or maximum lifetime benefit is the maximum dollar amount a health plan will pay in benefits to an insured individual during that individuals lifetime. Major-Medical Health Insurance plans cannot place lifetime or annual dollar limits on coverage.

Benefits are usually provided for the administration of drugs that cannot be self-administered. What also makes Physicians Mutual stand out is that there are no lifetime benefit limits on your plan. Policies issued on or renewing after September 23 2010 are required to have no.

At the age 47 the insured decides to cancel his policy and exercise the extended term option for the policys cash value which is currently 20000. In a group prescription drug plan the insured typically pays what amount of the drug cost. It does not include limited benefit plans fixed indemnity plans dentalvision plans accident supplements health care sharing ministry plans or critical illness plans none of which are regulated by the Affordable Care Act.

Maximum benefits refers to the upper limit of the total lifetime benefits the insurance company will pay upper limit percentage of what the insurance company will pay for coinsurance upper limits of what the insured will pay in out-of-pocket expenses upper limits of what an insurance company will pay for any particular claim. To include a stop-loss limit and a maximum lifetime. Major-Medical Health Insurance is comprehensive coverage which on average pays for at least 60 usually much higher of your expected healthcare costs throughout the year.

Oftentimes major medical plans with low premiums may be offset by other costs such as higher deductibles or cost sharing or a higher maximum out-of-pocket limit. 23 2011 and increases to 2 million after Sept. These plans are used only when the covered persons lack major medical coverage.

Under uniform required provisions proof of loss under a health insurance policy normally should be filed within. Maximum benefits for a major medical plan are usually lifetime. What is a lifetime maximum benefit.

The ACA did away with lifetime benefit maximums for essential health benefits. It depends on the needs of each person. Benefit levels for prescription drug plans are usually based on a monthly or annual benefit if there is a benefit limit.

Generally have annual or lifetime maximum benefits the majority of major medical and prescription drug plans do. The health care law stops insurance companies from limiting yearly or lifetime coverage expenses for essential health benefits. Insurance companies cant set a dollar limit on what they spend on essential health benefits for your care during the entire time youre enrolled in that plan.

Each person has a maximum of 60 such days they can use over their lifetime. Most plans have a small deductible for each prescription. The corridor deductible is usually a fixed dollar amount per loss.

Major medical health insurance in laymans terms is what people would generally consider real health insurance. If you reach your annual maximum youll need to pay for 100 of your treatments out-of-pocket. The health care law stops insurance companies from limiting yearly or lifetime coverage expenses for essential health benefits.

Which of the following would be a typical maximum benefit offered by major medical plans. Deductible is paid the major medical plan benefits come into effect. For example you might find a plan with a 1000 annual maximum and a lifetime maximum of 50000.

Major medical plans typically have a lifetime maximum. In this case they will pay 778 per day for each lifetime reserve day. Most plans have a maximum-out-of-pocket dollar limit which is the most.

A lifetime maximum is the maximum amount that your insurance benefit will provide during your lifetime. The difference between a 50000 and a 500000 lifetime maximum is. For those looking for more in-depth coverage Physicians Mutual can be a great fit if you.

In the first year insurers must cover medical expenses up to at least 750000. Under most policies the lifetime maximum applies only to non-essential healthcare services. Limits will be completely banned starting Jan.

Insurance companies can no longer set a dollar limit on what they spend on essential health benefits for your care during the entire time youre enrolled in that plan. An insured owns a 50000 whole life policy.

Can Health Insurance Policies Still Have Lifetime Or Annual Benefit Maximums Healthinsurance Org

Axa Health Max Visual Ly Health Medical Conditions Health Care

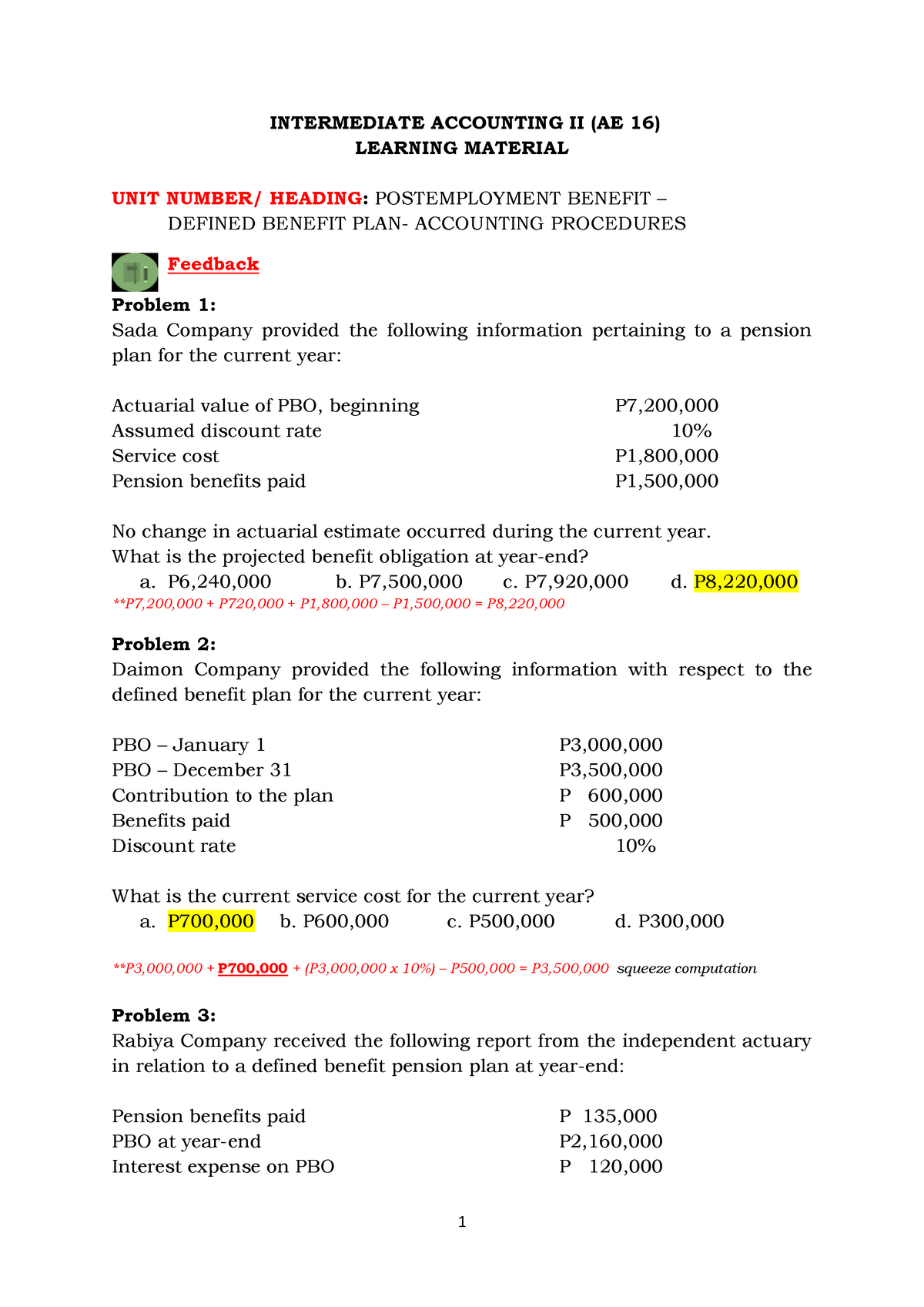

Defined Benefit Plan Exercises With Answers 1 Intermediate Accounting Ii Ae 16 Learning Studocu

Comments

Post a Comment